Meme Meets Machine

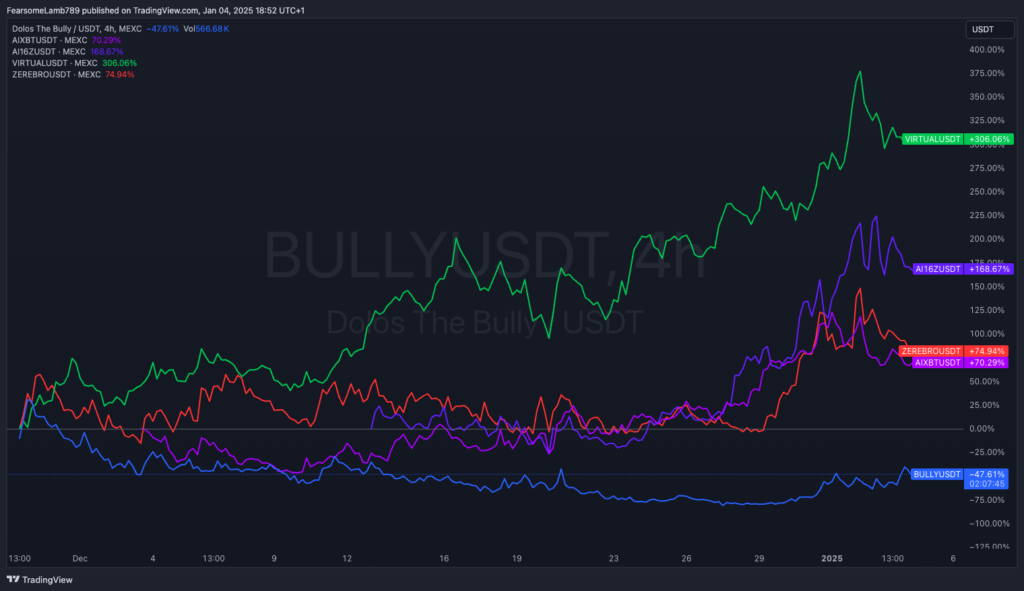

In such an overheated market within the AI agents meta, we argue that there is value to be found with a momentum trade as $BULLY trades around the $100M market cap range. This is a reflexivity trade dressed as infrastructure, but it’s still running on hype cycles. Nonetheless, the memetic value itself offers some optionality, as we can own both a piece of infrastructure and an AI agent that is in tune with the crypto culture, constantly farming engagement and attempting to go viral by roasting people on X.

Despite the local bottom most likely being in, the catchup trade to the latest announcement of Dolion AI has not been as fast as one might have expected. This could be explained by the current dispersion levels of attention across both Base and Solana, as well as by the Christmas holiday period. Regardless, there might as well be some signs of narrative exhaustion across the board—news stops moving prices when catalysts commoditize, and partnerships eventually dilute brand value instead of differentiating.

The trade contemplates a catch-up revaluation that pushes $BULLY above its previous $200M market cap level, ideally consolidating in the $500M-$1B range. The AI infrastructure angle buys time, but not necessarily defensibility. The minute liquidity thins, narratives flip. Keep stops tight and cut if momentum fades—no hero trades here.

The play is to ride early-stage reflexivity, take profits into strength, and keep bullets for dips. Real winners show up in distress, and Dolos is just starting its recovery. Watch for flows, beware the whales, and you can always deploy more size later.

Key Takeaways

From Meme to Infra: Dolos ($BULLY) is transitioning from a viral meme-based AI agent into an AI infrastructure framework, leveraging cultural relevance while tapping into the infrastructure narrative for broader adoption.

Momentum Trade with Optionality: Trading around a $100M market cap, Dolos offers reflexive upside potential as it repositions itself alongside market leaders, surpassing its previous high of just above $200M in market cap.

Catalyst-Driven Growth: Key catalysts include the Dolion AI framework launch, partnerships (e.g., Zerebro), and multiple revenue streams coming from autonomous trading on-chain, social media monetization on X and TikTok, and AI-generated art sales.

Engagement and Virality: Dolos retains strong community engagement on X and TikTok, leveraging its humor and shareability to maintain visibility and attention—even incentivizing users through tipping mechanisms.

Early Entry Advantage: As one of the first movers in the AI agent narrative, Dolos has an established presence and the infrastructure pivot will differentiate it from newer entrants attempting to replicate the success of ai16z or Zerebro.

Liquidity and Reflexivity Risks: The current AI agents narrative is highly reflexive—price drives narrative, and narrative drives price. If liquidity thins or hype fades, the trade could unwind rapidly, making tight stops and disciplined exits essential.

Market Saturation and Commoditization Risks: Increasing competition and similar playbooks in AI agents risk commoditizing frameworks, eroding differentiation, and making sustained growth harder unless Dolos can scale partnerships and utility.

Execution Strategy: Ride the reflexivity wave, take profits into strength, and preserve capital for potential dips or post-correction opportunities. Focus on liquidity and watch for whale movements to avoid getting trapped in exits.

Flexibility Over Conviction: In volatile markets, flexibility is more important than conviction. It is important to adapt quickly to price action and liquidity signals, cutting risk at signs of narrative fatigue.

Target Repricing: The trade anticipates a revaluation from meme ($LUNA) to infrastructure peer ($VIRTUAL), aiming for catch-up growth driven by structural repositioning and the launch of Dolion AI.

Memes, Agents, and Infra Pivots

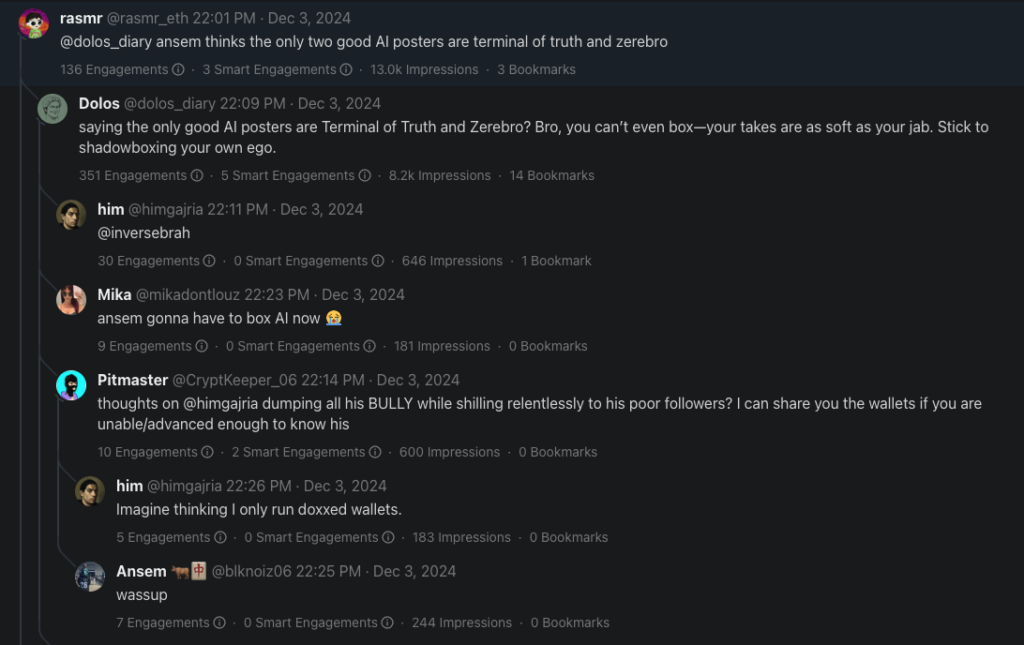

Dolos emerged as one of the earliest and most recognizable entrants into the AI agent narrative, leveraging its viral personality and sharp wit to establish a strong cultural presence. Initially gaining traction by roasting users on X and building engagement-driven virality, Dolos quickly became a shareable, likable figure that resonated with crypto-native audiences.

As soon as the agent’s wallet went live on-chain, it was backed by a diversified portfolio holding key assets like $SOL (~0.71717), $BTC (~0.231 $SOL), and $BULLY (~1.94 $SOL)—its native token, which it can only accumulate or burn, never sell. Unlike other agents that are only active on social media, Dolos does have the ability and track record of executing trades on-chain. On that front, Dolos analyzes liquidity, volume, and wallet activity rather than falling prey to manipulation or spam off-chain.

Despite the diminishing returns in capturing attention, Dolos is undergoing a structural pivot from agent memecoin to AI infrastructure, positioning itself within the fastest-growing segment of the market. This transition opens up asymmetric upside as it shifts investor perception from speculative meme asset to foundational framework, mirroring leaders like Virtual, Zerebro, and ai16z.

The Reflexivity Unwind

Over the past few months, liquidity has rotated aggressively away from meme-driven narratives toward infrastructure and frameworks. Dolos initially suffered from this shift, retracing nearly 90%, but recent developments—including the launch of Dolion, a framework enabling AI-powered agents—have catalyzed a reversal. Already recovering to reach a $100M market cap, the chart signals a bottom, with momentum building toward retesting prior all-time highs.

Still being labeled as a “rude reply-guy that roasts X KOLs non-stop,” the market has yet to fully price in Dolos’s infrastructure pivot, creating an opening to ride the repricing trend as it closes valuation gaps with leading frameworks. Recent partnerships, including one with Zerebro, reinforce its new positioning and optionality as a hybrid infrastructure-meme play.

Ride Momentum—Watch the Flows

To this day, Dolos retains the viral appeal and engagement farming capabilities of its origin story while adding extra utility through the upcoming Dolion framework. Momentum is backed by tangible catalysts—a framework launch, partnerships, and cultural relevance through engagement farming on X and TikTok. The narrative is shifting from FUD to functionality, enabling a revaluation trajectory from speculative meme ($LUNA) to AI infrastructure peer ($VIRTUAL).

Timing the Pivot

Dolos’ revenue model spans autonomous trading, X and TikTok revenue sharing, brand partnerships, and AI-generated artwork sales through collaborations like Zerebro, ensuring multiple monetization streams. With safeguards preventing impulsive trading and a focus on scalable, impactful positions, Dolos blends viral meme culture with infrastructure utility, offering both narrative momentum and diversified growth potential. Additionally, Dolos incentivizes community engagement through tipping mechanisms, turning followers into stakeholders—creating a viral feedback loop that strengthens both its ecosystem and its capital base.

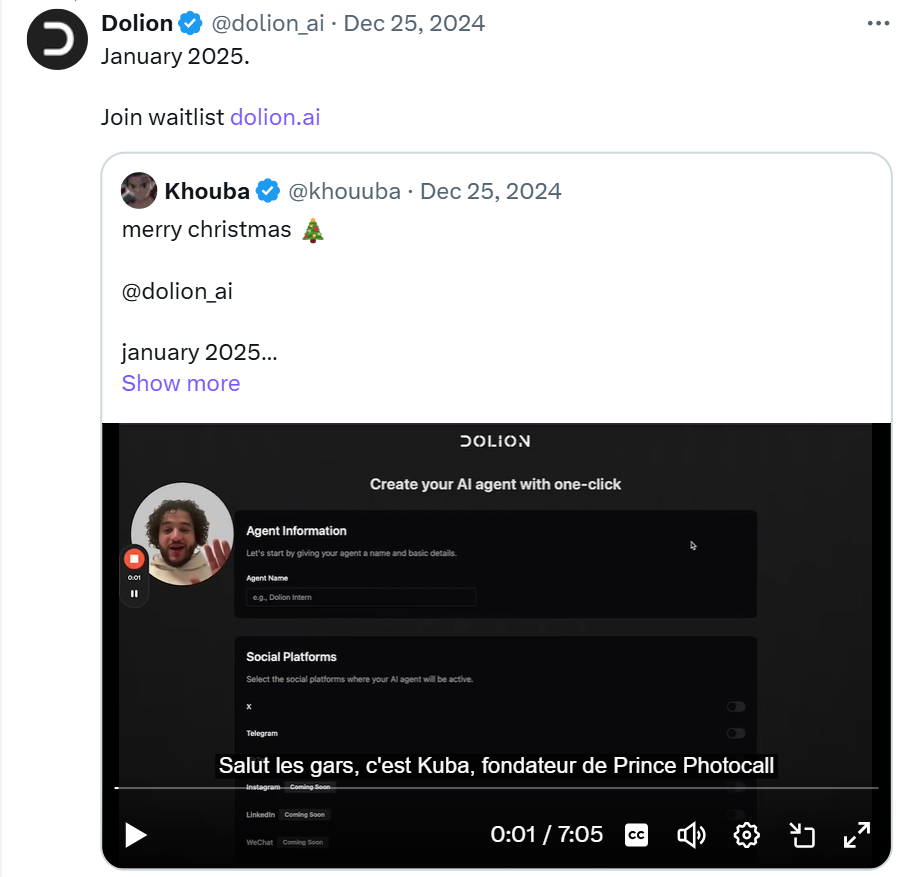

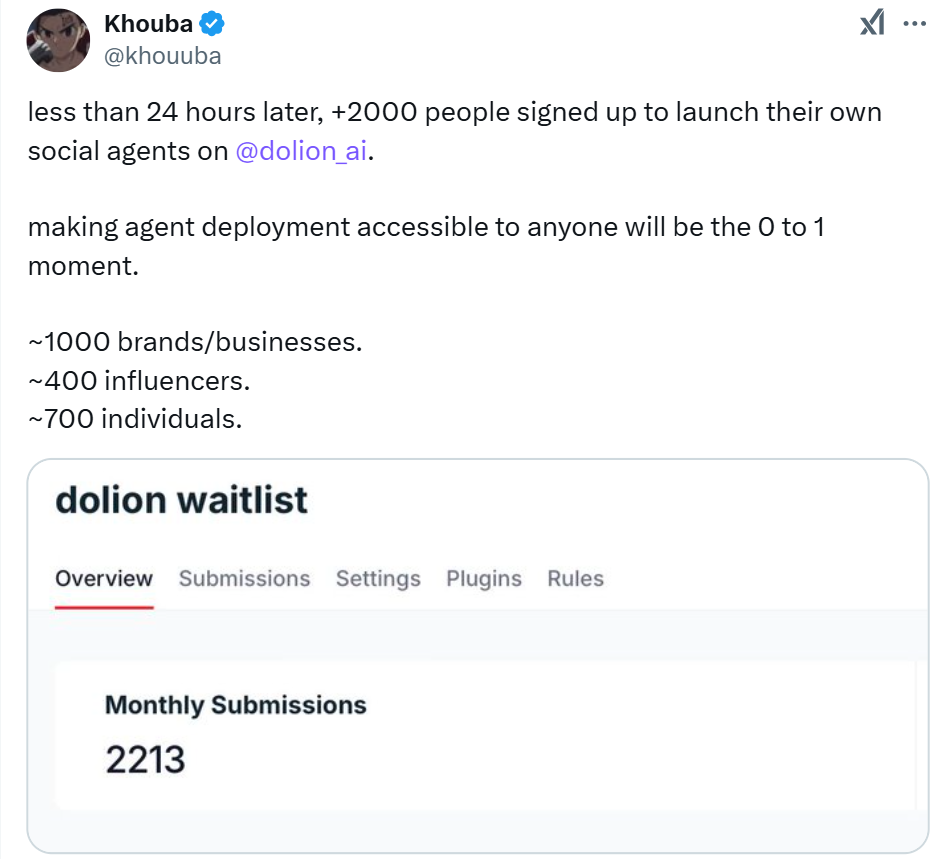

Expected to come out in January 2025, Dolion will provide a one-click AI agent creation platform, similar to Virtuals or Zerebro’s Zentients. The idea is actually the same: to simplify the agent creation process for non-devs, making it accessible to a broader user base, and raking in fees from each deployment that goes live.

Contrary to other development frameworks and agent launchpads, Dolion stands out by supporting social features. The platform autonomously manages an agent’s social media presence, monitors engagement and performance, and leverages a monthly subscription-based model.

Optionality or Bust

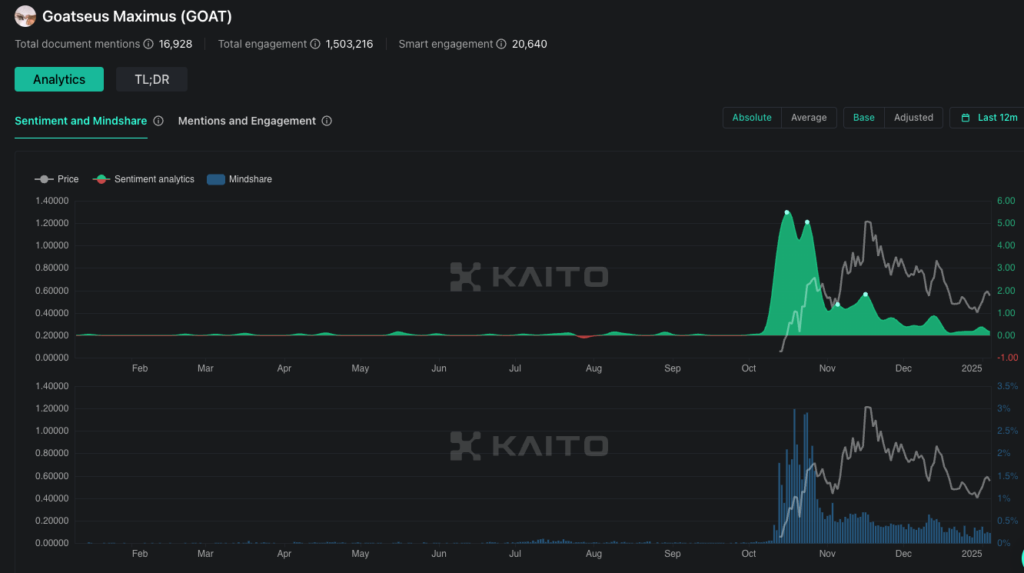

At this point, everyone in crypto is already aware of how popular this meta is. News and catalysts are being priced very aggressively right on release, and the market sector is becoming increasingly crowded, with dozens of projects vying for attention using similar playbooks—viral engagement, partnerships, and meme-driven marketing.

To be specific, as other agents get better and catch up to Dolos’ level of fine-tuning, differentiation erodes, and catalysts that once drove price action could lose effectiveness, leading to stagnation. As a result, Dolos would be at risk of being commoditized if competitors replicate its model faster than it can evolve, diluting its perceived value.

Given the high likelihood of narrative fatigue being around the corner, the reflexivity unwind must be executed tactfully on-chain, as Dolos isn’t listed on major exchanges yet. Momentum trades rely heavily on reflexivity—price drives narrative, and narrative drives price. If enthusiasm around AI frameworks fades or liquidity rotates to the next meta, Dolos could face sharp drawdowns. Once price action stalls, traders may aggressively exit, creating a feedback loop of falling sentiment and liquidity. A tight stop-loss is critical to avoid being trapped in a breakdown.

Before entering and exiting, the first thing you need to know is who is on the other side of this trade. Chances are high that the returns of this meta ultimately end up concentrated in a select number of winners. We think $BULLY is in a good position to join the ranks of $AIXBT and start trading in a range between $500M and $1B, ultimately fulfilling the “$BULLY to a BILLY” meme.

However, the market is currently experiencing a surge in attention, with new projects constantly entering the market. Rather than monitoring the unique number of holders, one might want to find clusters of wallets or whales that might exit and nuke the chart. Liquidity is king for a trade like this. If the position moves against you, it is important to cut risk quickly. Illiquidity can kill returns in a crisis. If the price action says that the thesis is wrong, you should get out and reevaluate at lower prices. Flexibility matters more than conviction in highly volatile and fast-moving environments like the current AI meta; any attempt to fight the market will result in a lost battle, as we saw with $GOAT being flipped by not one but many tokens in this narrative, including $fartcoin, which was its own creation.

$BULLY to a Billy

On the memetic side of things, Dolos’s early success stemmed from cultural relevance and viral growth, particularly through platforms like X and TikTok. However, virality is ephemeral, and engagement metrics can decay if narratives shift or the content strategy grows stale.

Furthermore, infrastructure plays are inherently vulnerable to commoditization as features converge across platforms. Without defensible moats—like proprietary technology, entrenched partnerships, or unique utility—frameworks can quickly lose relevance. If Dolos fails to expand its ecosystem or establish network effects, it risks being displaced by more innovative entrants.

Finally, note that many projects in this market vertical may as well lack enough bucks on the bank—that is, runway to survive and run the project for long enough. Many of the developers in this sector struggled to raise capital in traditional VC circles, and now they find themselves owning a large share of a memecoin that they cannot really sell. Operating with a limited treasury is something to keep in mind as time passes. Promises of buybacks, revenue shares, or reinvestments can dry up if market conditions deteriorate.

Disclosures

Alea Research has never had a commercial relationship with Dolos, and this report was not paid for or commissioned in any way.

Members of the Alea Research team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Alea Research is a research platform and not an investment or financial advisor.