Introductiondfdf

While Bitcoin was conceived as a pristine monetary asset, its original design did not contemplate a blockchain hosting decentralized applications that would unlock productive use cases for $BTC with yield-bearing opportunities for holders. Despite having the largest market cap in crypto ($2T+), $BTC remains underutilized, as its native scripting limitations prevent meaningful onchain programmability. As a result, the majority of this capital sits idle in wallets, treasuries, and custodial silos. GOAT Network proposes a technical solution to make that idle $BTC productive, and bring it onchain.

GOAT Network is a Bitcoin-Native ZK Rollup purpose-built to unlock yield that is paid in $BTC, without compromising the asset’s security or the network’s censorship-resistance. It introduces smart contract capabilities to Bitcoin’s economic base using zero-knowledge (ZK) proofs and a trust-minimized design that delivers non-inflationary $BTC-denominated yield.

GOAT’s vision is to reframe $BTC utility not just as a passive store of value but also as a productive resource that enables DeFi without synthetic asset issuance, rehypothecation, or custodial risks. Its architecture integrates native Bitcoin compatibility with zkVM infrastructure, enabling an ecosystem of dApps that inherit Bitcoin’s security guarantees while accessing EVM-style composability.

Currently, GOAT sits between two forces: the growing demand for capital-efficient, yield-generating Bitcoin infrastructure and the institutional appetite for trust-minimized, $BTC exposure. The result is a network that aims to scale Bitcoin and enable various applications to operate on top of it.

Key Takeaways

A Trillion-Dollar Market Cap Earning No Yield: GOAT wants to transform $BTC from a passive store-of-value into an active, yield-generating asset, capturing a largely untapped market. ETFs alone hold more than 1.4 million $BTC earning nothing.

$BTC Denominated Yield: All network rewards, such as transaction fees, sequencer MEV, and lending interest, are paid directly in $BTC, with the yield derived from economic activity taking place on GOAT Network using $BTC as the canonical asset for fees.

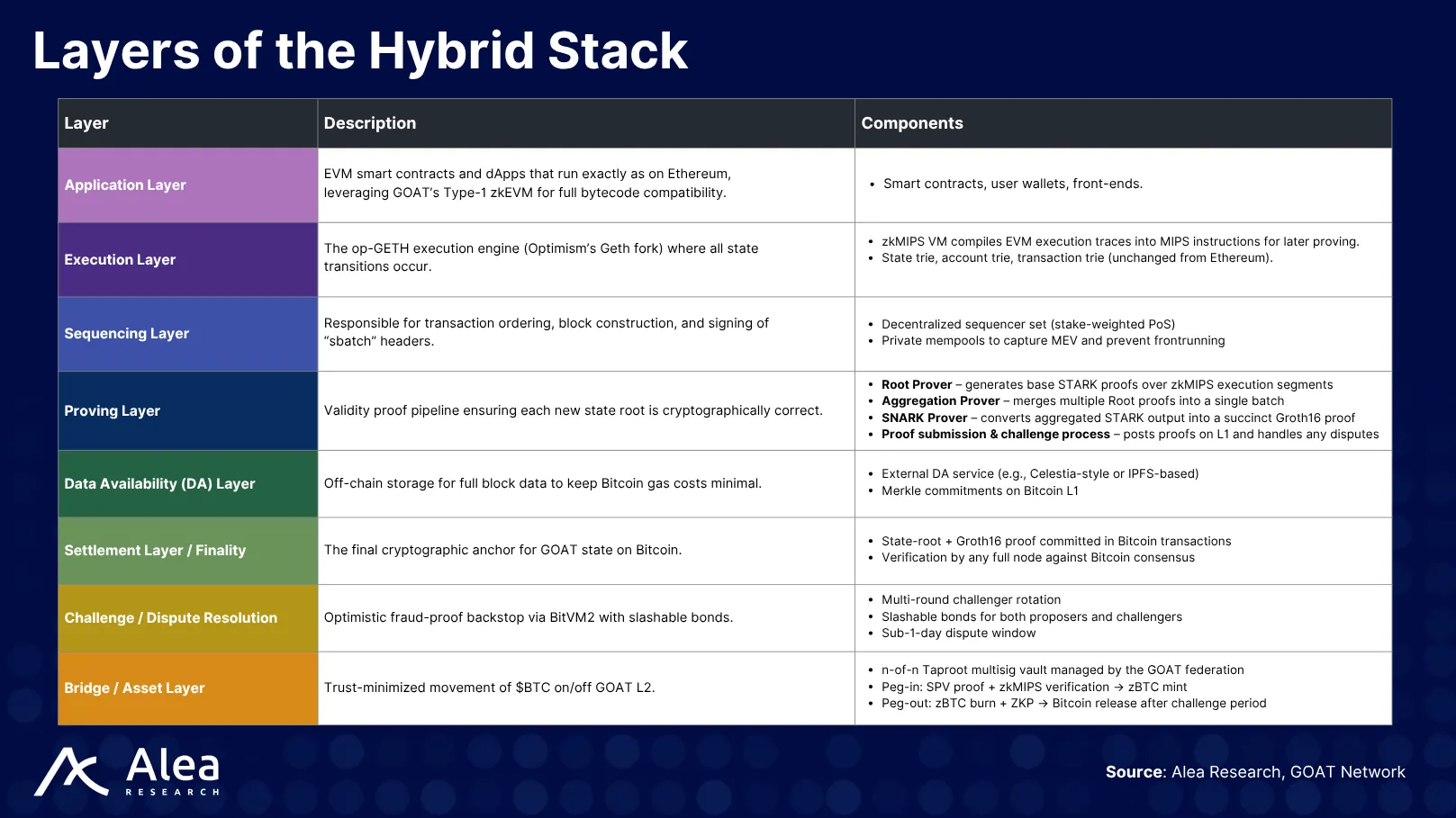

Hybrid Architecture Stack: A stack combining zkVM, Ziren, BitVM2, a decentralized sequencer set, and trust‐minimized bridging, enabling programmability and finality on Bitcoin L1.

Network-Driven Feedback Loop: Multi-asset support, EVM compatibility, and network effects create a feedback loop that grows activity, liquidity, and native $BTC yield.

Macro Tailwinds: ETF inflows, corporate and sovereign $BTC accumulation, and supply squeezes, reinforce demand for non-custodial, yield-bearing infrastructure. A 5-10% APY on a portion of these holdings can earn substantial returns.

Execution Dependencies: Long-term success depends on attracting quality dApps, sustaining deep liquidity, bridging developer communities, and maintaining robust protocol activity.

Bitcoin Security & EVM Flexibility

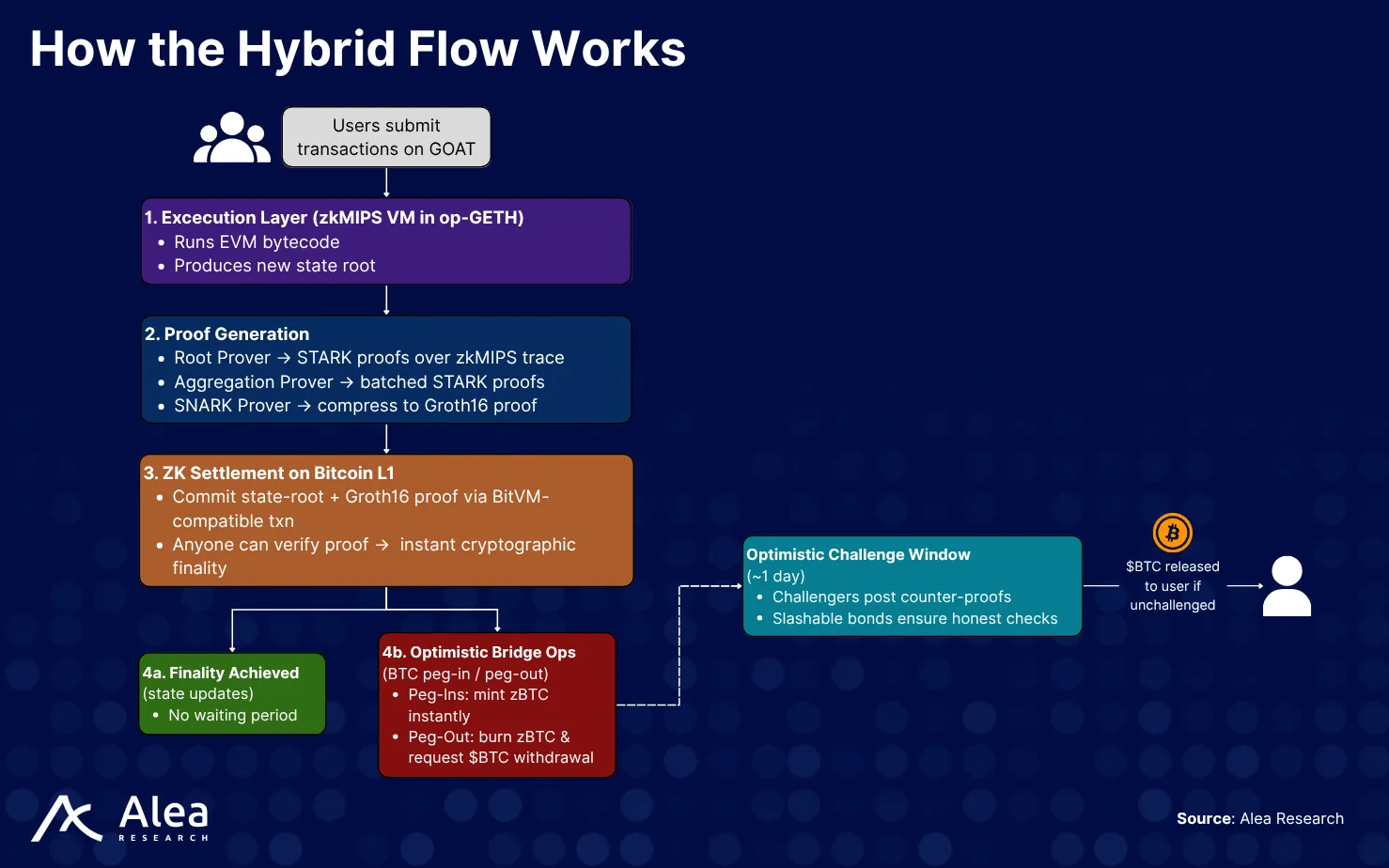

GOAT Network’s architecture is designed to reconcile two traditionally incompatible traits: Bitcoin’s conservative security model and the composability of Ethereum-style smart contracts. To achieve this, GOAT implements a hybrid stack that layers a zkVM execution environment over Bitcoin’s consensus and finality guarantees.

The security model combines zero-knowledge settlement with an optimistic challenge window to deliver both instant, math-based finality for L2 state updates and a crypto-economic backstop for $BTC bridge operations.

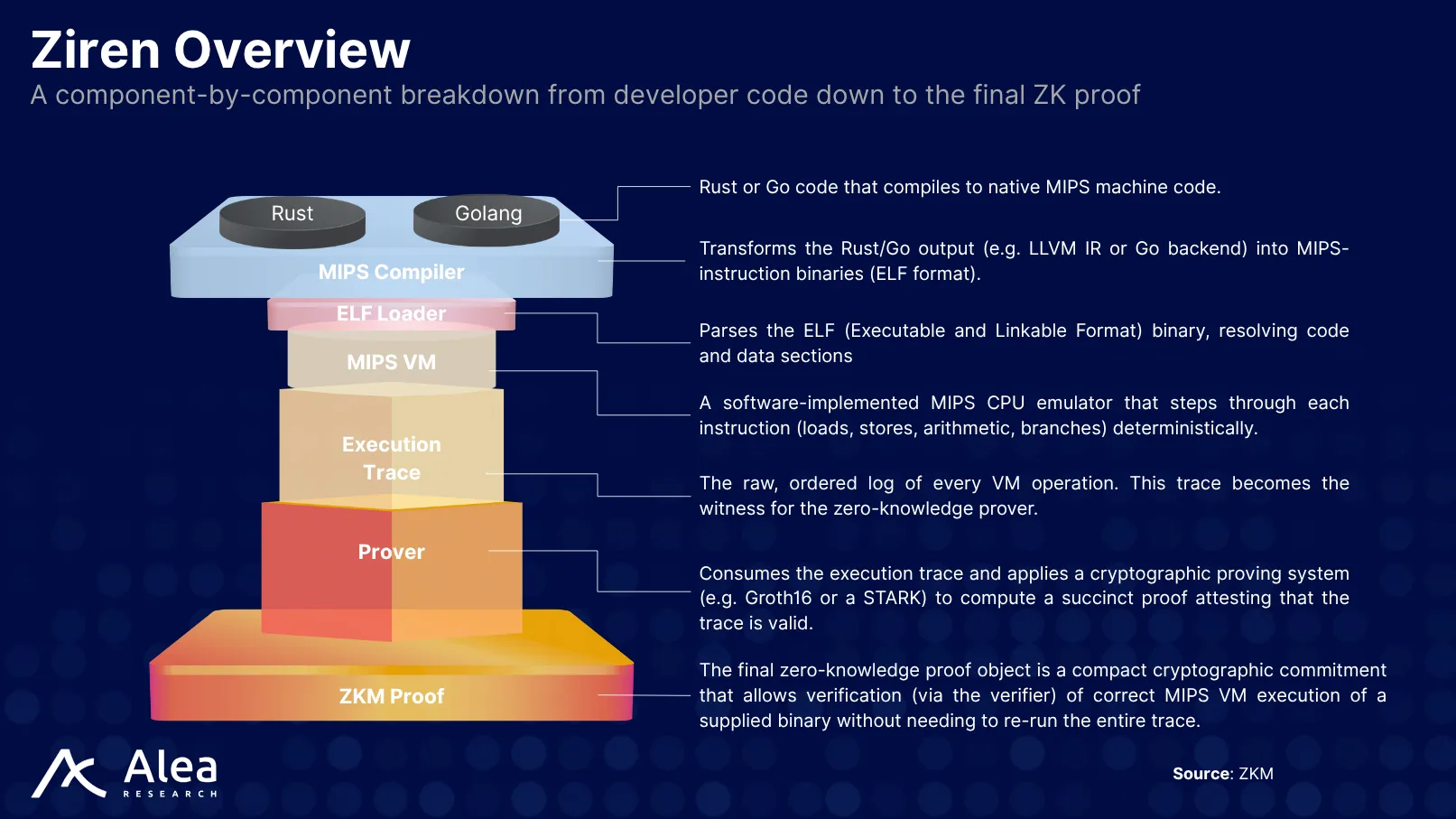

The core component is a Type-1 zkEVM: a bytecode-compatible ZK virtual machine that mirrors Ethereum’s execution logic while enabling fully provable computation. This allows for seamless deployment of existing EVM contracts without modification, while retaining fully ZK-proven state transitions. To enable execution between Bitcoin and the zkVM layer, GOAT incorporates Ziren (formerly zkMIPS), a ZK prover designed to verify computations made under the MIPS architecture. This acts as a critical compatibility layer with BitVM2, an emerging Bitcoin-native computation framework that enables offchain programmability verifiable via Bitcoin Script. BitVM2 allows GOAT to anchor settlement logic directly to Bitcoin L1, while its Optimistic Challenge Protocol (OCP) ensures dispute resolution with minimal overhead, optimizing both speed and finality assurance.

GOAT’s design includes a Dual Slashing Model, which combines Bitcoin-level slashing with its own consensus slashing, making attacks exponentially more expensive. The system employs economic incentives and bonding to ensure participants act honestly, as misbehavior leads to a slashing of their stake.

- Bitcoin-level Slashing: Via BitVM2 fraud proofs on L1, any malicious operator’s $BTC collateral in the kickoff transaction locked by the operator is forfeited and awarded to the successful challenger. In other words, if an operator misbehaves, it cannot finish its reimbursement to the specific UTXO it chooses.

- GOAT Consensus Slashing: On GOAT, sequencers, provers, and challengers stake bonds that are instantly seized for misbehavior (e.g., double-block proposals or missed challenges). Therefore, a single instance of fraud triggers slashing on both chains, making attacks exponentially more costly.

For execution and censorship resistance, GOAT uses a Decentralized Sequencer Network, eliminating the need for centralized ordering mechanisms. Sequencers submit transaction batches to the zkVM, generate validity proofs, and coordinate cross-domain messages. Importantly, this design aims to reduce the concentration of sequencing power and associated MEV centralization risks, which are common problems in rollup ecosystems.

Key features and benefits of GOAT’s decentralized sequencer network include:

- Trustlessness: It ensures no single party can manipulate transaction order for profit, relying on a distributed consensus mechanism.

- Censorship Resistance: Transaction sorting occurs through a globally distributed network of nodes, preventing any single party from censoring or hindering network operations.

- Improved Liveness: By eliminating single points of failure, the network remains operational even if some nodes fail, boosting its resilience.

Unlike centralized sequencers, GOAT uses a multi-operator PoS model. Entities wishing to act as sequencers must stake $BTC (0.5 $BTC on Alpha Mainnet) and be whitelisted (as of now) to earn the right to produce blocks and earn $BTC gas rewards. After TGE, sequencers will also be able to earn $GOATED mining rewards.